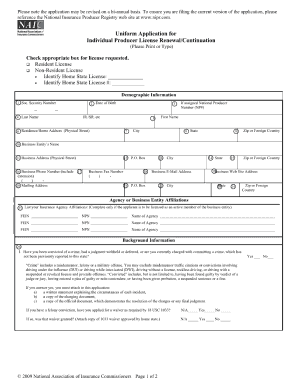

Get the free application insurance license form

Get, Create, Make and Sign

How to edit application insurance license online

How to fill out application insurance license form

Who needs application insurance license?

Video instructions and help with filling out and completing application insurance license

Instructions and Help about naic application form

Hi there my name is Kevin, and I am from health agent Academy comm and I also handle training for new agents for a health insurance general agency and I just want to take this time just to show you how to get an insurance license in the state of California now again the objective of this just to make sure got the right people watching this video what we're going to show you here is how to get a license to sell both life insurance and health insurance in the state of California as a California resident if you're looking to sell insurance in California and you don't live in California you want to first get a license in your state and then assuming the state you live in has a reciprocal agreement with California you'd be able to set up what's called the non-resident license, but we're going to show you how to get a resident license in the state of California so the license we're going to show you is referred to as a full life agent what that means is that includes both an accident and health license and a life only license in California there are actually two different licenses, but you can apply to do them as one now you can get just the accident and health license or just the life only license now my recommendation is if you're going to go ahead and take the time and the effort to get a license you might as well in just vests a little more time in studying just so you can get both because otherwise you'd have to go back in later on and take another exam take another licensing course and get whichever you didn't already have so if you already had the accident health you have to then later on get the life only you might as well just start from scratch and just have it all so if you ever get the edge to cross-sell or from the beginning if you think you may want to cross-sell so if you're going to sell life insurance maybe to those clients you want to also sell health insurance or accident policies of some sort, so I always think it's a good idea if you're going to go ahead and invest the time and effort again go ahead and just do both but again if you're going to just do one or the other the steps we're going to outline for you will actually work for you as well so just to show you what those steps are I'm just going to briefly run through those steps down below I've got more in-depth notes, and I'm going to walk you through as well more in-depth but just to quickly run through that first thing you're going to do is sign up for a free licensing course that's just a course to tell you a little more about insurance and what the expectations are of you as an insurance agent, and then you're going to want to get your fingerprints taken than you're going to schedule your exam because you're going to have to sit for a state exam, and you're going to have to apply for both licenses California as I said it's basically getting two different licenses, but you can get them both at the same time, and then you need to pass your test and that is the state exam,...

Fill naic uniform application : Try Risk Free

People Also Ask about application insurance license

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your application insurance license form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.